As victims of Jeffrey Epstein sue Deutsche Bank and JPMorgan, we ask: “Why aren’t they also going after Barclays and Jes Staley also?”

Whilst yesterday grubby groper Ghislaine Maxwell got to get out of her cell for a few hours to max out on a novel nosh-up consisting of a vegan turkey replacement named Tofurky®, news was breaking that Deutsche Bank AG and JPMorgan Chase & Co. were being sued by two unnamed women in connection to her late lover, Jeffrey Epstein, being enabled by them.

Clearly making a stramash out of the fact that there’s still plenty of Epstein cash floating around, two separate lawsuits filed in the U.S. District for the Southern District of New York on Thursday allege the financial institutions knowingly benefitted from “assisting, supporting, facilitating, and otherwise providing the most critical service for the Jeffrey Epstein sex trafficking organisation to successfully rape, sexually assault, and coercively sex traffic” the women in spite of their having knowledge about Epstein’s nefarious activities.

Going further the anonymous plaintiffs allege that both firms were happy to “earn millions of dollars” facilitating a since croaked and already convicted paedophile criminal and “chose profit over following the law.” Here were institutions, the alleged victims stated, ignored “red flags” and of them, Bradley Edwards, a lawyer in one of the cases, stated: “The time has come for the real enablers to be held responsible, especially his wealthy friends and the financial institutions that played an integral role. These victims were wronged, by many, not just Epstein. He did not act alone.”

They add that Epstein would have been unable to keep his sex trafficking operation going without “the assistance and complicity” of banking institutions and that the involvement of Deutsche and JP Morgan gave “the appearance of legitimacy.”

In another part of the filing, featured in the DailyMail.com, it was further observed that the two firms “knew that Epstein would use means of force, threats of force, fraud, abuse of legal process, exploitation of power disparity, and a variety of other forms of coercion to cause young women and girls to engage in commercial sex acts” and “also engaged in repeated acts of racketeering activity to support the Epstein organisation.”

Tellingly, the online title also shared: “[Deutsche] was fined $150 million by state regulators in 2020 for failings which included not intervening as Epstein paid women’s tuition and gave suspicious payments to Russian models and women with Eastern European names. The [firm] had a responsibility to monitor his accounts because he was a registered sex offender.”

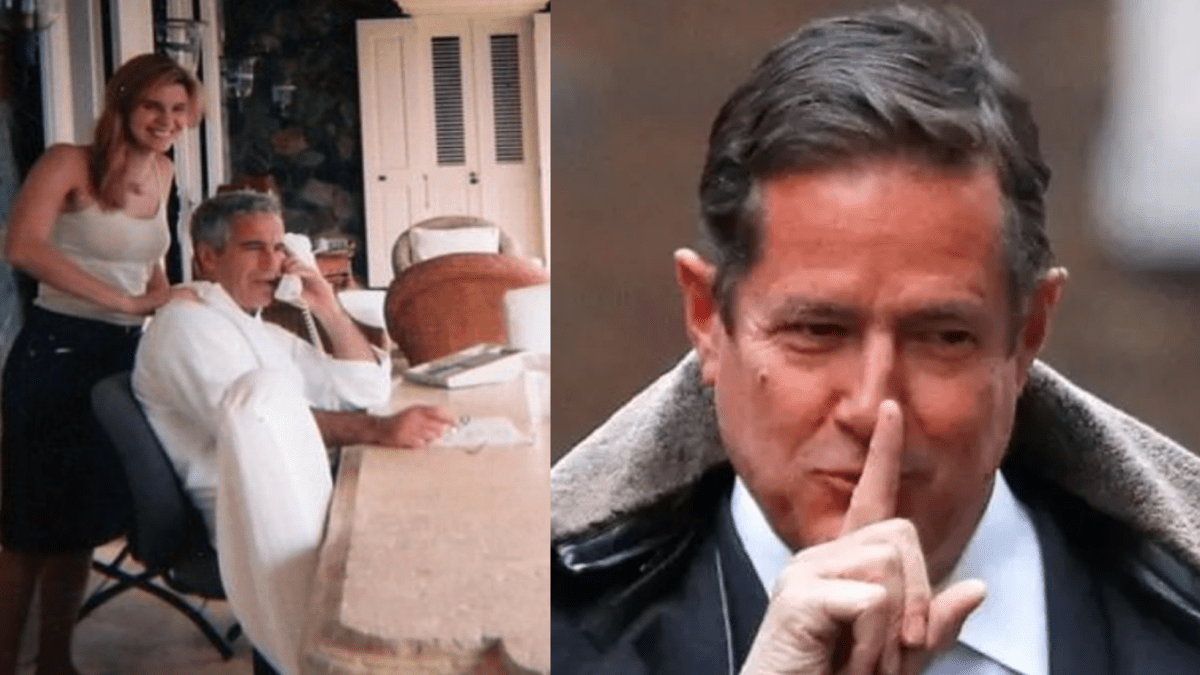

Whilst Deutsche told The Hill that “this claim lacks merit” and JPMorgan “declined to comment,” one is left asking why these two women haven’t also gone after another key player in this matter, Barclays, and its quite rightly now disgraced Epstein ‘bestie’ former CEO, Jes Staley.

Editor’s Note – Unlike as is the case in many publications, this article was NOT sponsored or supported by a third-party.