Tiny Knightsbridge studio on the market for the bonkers sum of £1.375 million or £3,000 per square foot will set a new record if it sells for its asking price

Priced at £3,029 per square foot ($4,221 or €3,834 per square foot), a pint-sized studio flat in Egerton Gardens, Knightsbridge has been placed on the market for the not so insubstantial sum of £1.375 million ($1.916 million, €1.741 million).

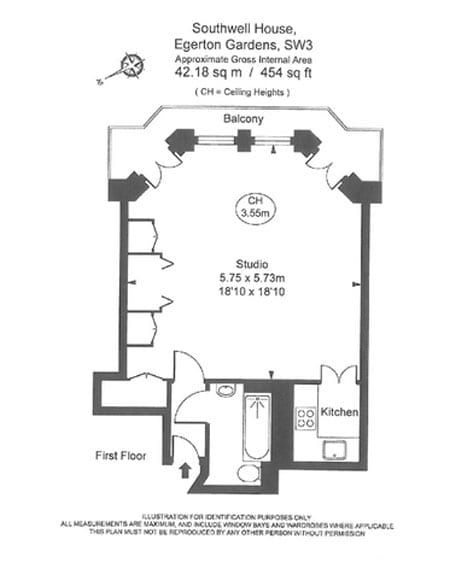

Comprising of just 454 square foot of accommodation on the first floor of a red brick block named Southwell House, the somewhat dated apartment consists of an 18’10” square room with a balcony, a tiny kitchen and an equally minute bathroom.

The apartment – which is accessed by a lift and comes with access to communal gardens – is for sale through Hobart Slater. If it achieves its asking price it will make another studio in Egerton Gardens that we featured in January 2016 seem cheap – that particular property was offered for £2,268 per square foot ($3,284 or €3,025 per square foot) or £1.175 million ($1.7 million or €1.6 million).

If ever there were a sign of an overheating market, this is it: In 1988, a broom cupboard in Knightsbridge sold for £36,500 (the equivalent of £91,789 or $127,756 or €115,952 today). Months later, the economy collapsed and studios, given their limited appeal, were the first to see their values plummet.

Subscribe to our free once daily email newsletter here:

Get a life

In my case I think it is “get a lift” 🙂

Or in the case of the owner of this pad, they’d like a dramatic price lift.

It’d make a great shag pad!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! Whoever buys it better be big down below too!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

The other one was much better in terms of its position as this one is closer to the main road. It is also smaller, needs renovating (the other was already done) and it is more expensive. The seller plainly is being very greedy and the agent is taking a punt in the hope of getting a chunk of change as commission.

Rod, the only shag you would ever get is one you had to pay for. Even discounting the fact that you are Australian you just look so ugly….and those huge ’70’s glasses accentuate your sheer porkiness.

I do wish Matthew would put up your picture. I suppose he is too much of a gentleman to belittle you in that way.

Same size as my garage, wot a w**k.

Rod, stop showing us up over there cobber.

The very least I would expect, would be a Clive Christian Kitchen, not that B&Q crap.

It never ceases to amaze me at the quality of Kitchens in these £1m+ Apartments.

The people buying this will be making the same mistake as anyone who buys any overpriced commodity in a bubble. The super rich whose purchase of large properties in the same area artificially set the price, are never going to buy a tiny place like this so went the collapse comes it reverts to its real value. It’s like believing that because you park you VW Golf in a street full of Rolls Royces that it somehow makes your car worth more.

I always say that I have regretted each of the 33 flats(and one house) that I have owned and then sold in Prime C. London.

Prices might come off for a couple of years, but then rebound dramatically.

The FTSE 100 index has been around, I think, for 30 years. In that time PCL has substantially outperformed the Index.

The thing about the best areas of C. London is that most owners are either ungeared, or have very little so are not over affected by market vagaries…or let’s hope so!